Introduction

Commission in sales is more than a bonus. It is the foundation of many contracts between companies and those who sell on their behalf. Defined clearly, it sets the rules for how results are rewarded and how both sides share the value created. Left vague, it becomes a source of tension and mistrust.

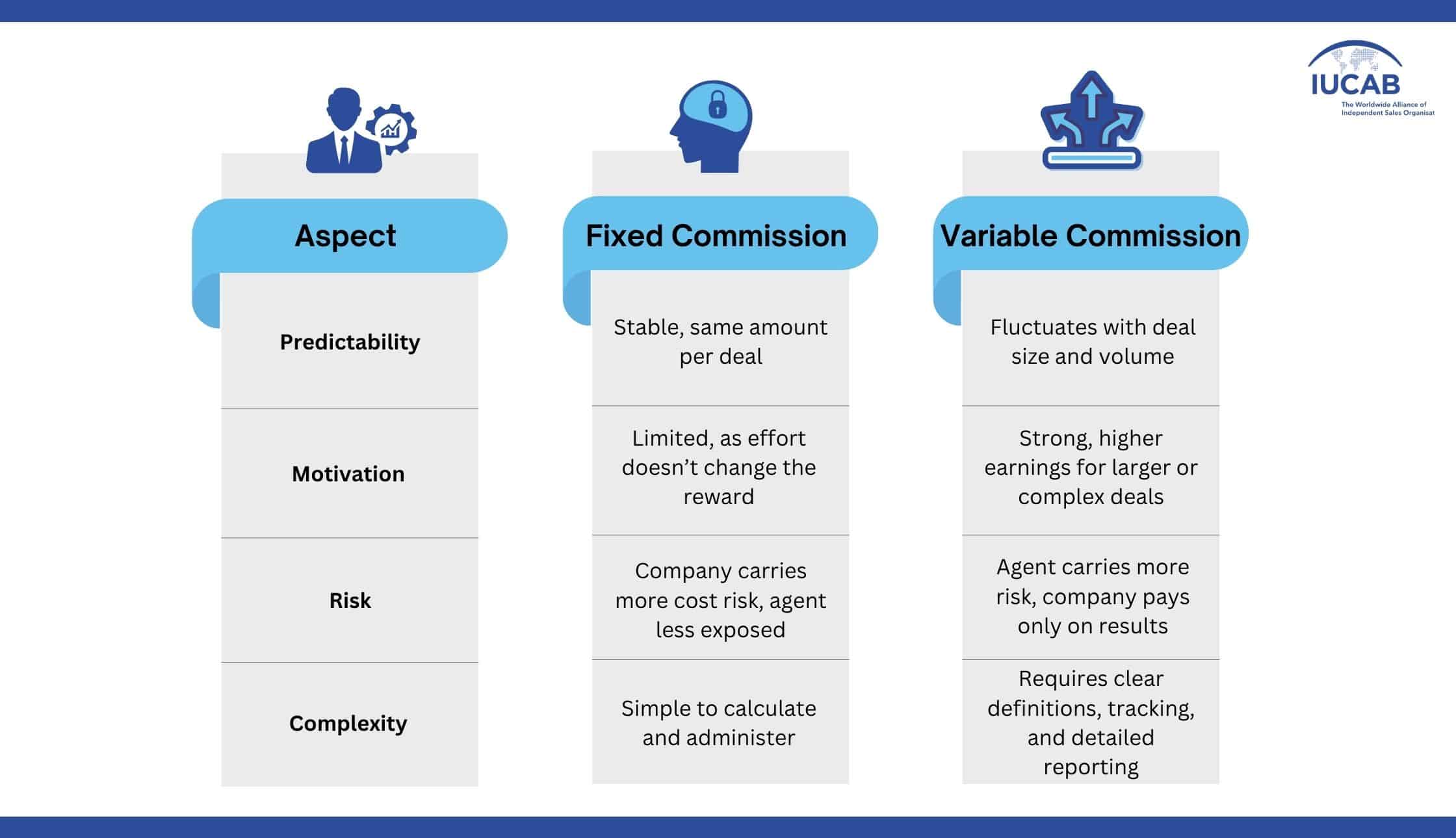

The form this commission takes is not always the same. Some contracts fix the amount in advance, offering stability but less flexibility. Others tie it directly to performance, creating powerful incentives but also more volatility. Between these two models lies the question every business faces: how should commission in sales be structured to balance security, motivation, and fairness?

Fixed Commission Explained

Definition

Fixed commission in sales contracts means the commercial agent receives a set amount per transaction, unit, or client. The rate does not change with the value of the sale. It is a simple model that ensures predictability for both sides.

Pros and cons

The strength of this system is clarity. Companies know their exact cost per deal, and agents know their earnings from the start. But the limitation is that it does not always match the effort required for larger or more complex sales. To go further on the balance between fixed and variable models, please read our article “Understanding a typical sales commission structure.”

Example in practice

In real estate leasing, some contracts pay agents a flat fee per signed rental agreement. The amount remains the same whether the property is small or large. This creates efficiency in processing high volumes but can under-reward agents handling more demanding transactions.

Variable Commission Explained

Definition

Variable commission in sales is calculated as a percentage of the revenue or profit generated. The agent’s income rises in direct proportion to the value of the deals closed, creating a strong link between performance and reward.

Pros and cons

The main advantage is motivation. Agents are incentivized to seek larger or more profitable opportunities, since their earnings grow with each sale. For companies, it aligns commission costs with actual revenue. The downside is volatility: results fluctuate, and without clear rules, disputes may arise over what counts as the sales base.

Example in practice

This model is common in SaaS, where agents receive a percentage of the subscription value they bring in. It is also frequently used in retail distribution and in B2B manufacturing contracts where order values vary significantly.

Comparing Fixed and Variable

Fixed commission brings stability and clarity, making it easier to manage costs and expectations. Variable commission ties income to results, which boosts motivation but introduces more uncertainty. The choice depends on whether predictability or performance is the greater priority in a given sales relationship.

Hybrid & Mixed Models

Retainer + variable

Some contracts combine a modest retainer with commission on sales. The retainer provides stability, while the variable part ensures that performance remains central. This balance is common in long B2B cycles where effort stretches over months.

Tiered systems

In this arrangement, the rate increases once a sales threshold is passed. An agent might earn 5% on the first orders, then 7% beyond a set volume. The goal is to reward growth and push activity beyond the minimum expected.

Guaranteed minima or clawbacks

Certain contracts guarantee a base level of earnings, protecting the agent during slower periods. Others add clawback clauses, where commission must be returned if a deal is canceled or a client defaults. These mechanisms are safeguards, ensuring neither side carries all the risk.

Contractual Considerations

In any contract, the definition of “sale” must be clear. Some agreements calculate commission on gross sales, others on net of discounts or even on margins. If this point is left open, it quickly becomes a source of conflict when deductions are applied.

Timing is another essential clause. In the European Union, the Commercial Agents Directive (86/653/EEC) states that commission becomes due once the client has paid, and it must be settled within a reasonable period. In the United States, the rules change from state to state. In places like California or New York, companies are required to put commission terms in writing and to respect strict deadlines once the payment has been earned.

Contracts should also cover what happens in the case of returns or cancellations. Under EU law, an agent is not entitled to commission if it is clear that the deal will not be carried out, unless the company itself is responsible. In the US, this is usually defined directly in the contract, with state law stepping in if nothing is written.

Finally, dispute resolution needs to be anticipated. European legislation obliges companies to provide agents with regular statements of commission, while many US states allow agents to claim penalties if payments are delayed. Clear clauses on jurisdiction and mediation help both sides avoid unnecessary conflict.

Financial & Accounting Impact

- Fixed commission as a liability

When a contract guarantees a fixed amount, it is recorded as a liability regardless of sales volume. Under IFRS 15 (Revenue from Contracts with Customers) and US GAAP ASC 606, such obligations are recognized as expenses once the agent has performed the service. - Variable commission as a cost

Commission linked directly to sales is considered a variable expense. Both IFRS and GAAP require that it be recognized in the same period as the related revenue, which keeps costs aligned with performance. - Cash flow considerations

Fixed commissions create predictable outflows, even in slow periods, while variable commissions fluctuate with revenue. This difference influences how companies manage working capital. - Forecasting and margins

Fixed structures make budgeting easier but reduce flexibility. Variable structures protect margins in downturns but create uncertainty in financial forecasts. Accounting standards require disclosure of significant commission costs when they materially affect profitability.

Best Practices

Define terms with precision

A contract must clearly state how commission in sales is calculated, what counts as the sales base, and when payment is due. Without this, even strong partnerships can run into conflict.

Respect accounting rules

Commission models should be designed with IFRS 15 or ASC 606 in mind. These standards require that costs follow revenue recognition. Ignoring this leads to adjustments later, and sometimes to disputes with auditors.

Test different scenarios

Running projections helps both sides see how the model behaves in good times and in downturns. A contract that looks fair on paper may prove unsustainable if sales slow, or ineffective if it caps motivation when business grows quickly.

Review agreements regularly

Conditions change: margins, client expectations, even regulations. Revisiting the agreement once a year ensures the structure still reflects reality and remains motivating.

Keep trust at the center

Numbers are only part of the story. Regular commission statements, open communication, and transparency in calculations build confidence. Trust is what makes the contract work over the long term.

Closing Thoughts

Commission in sales is more than a line in a contract. It is the tool that aligns the motivation of the agent with the goals of the company, creating a shared interest in performance and results. When it is clear and transparent, it builds trust and supports lasting business relationships.

There is no single best model. Fixed, variable, or mixed structures each have value, and the right choice depends on industry, margins, and company maturity. What matters most is balance, a system both sides understand and accept, where risk and reward are shared fairly.